Almost 36% of Americans have more credit card debt than emergency savings, and 57% of Americans don’t feel they have enough money to fall back on, according to Bankrate. Employees can receive their earned income before the regular, scheduled payday thanks to earned wage access (EWA), commonly referred to as on-demand pay.

Access to earned wages enables businesses to better assist workers’ financial well-being, which makes everyone in the company happier and more productive.

What is Earned Wage Access?

Earned wage access (EWA), often known as on-demand pay or immediate payroll, is a financial advantage that gives workers access to their money outside of the regular payment cycle. They just ask for some or all of their earnings and get the remainder in their usual payment on payday, rather than waiting for their weekly or biweekly pay to arrive.

In 2015, DailyPay was one of the first companies to offer earned wage access. On-demand pay is available at roughly 71% of middle-market companies, however it might not be suitable for everyone. Indeed, according to 53% of users polled, EWA is crucial to their future employment choices.

History of Earned Wage Access

Gig workers began using EWA in the early 2010s, and during the COVID-19 pandemic, more EWA suppliers appeared.

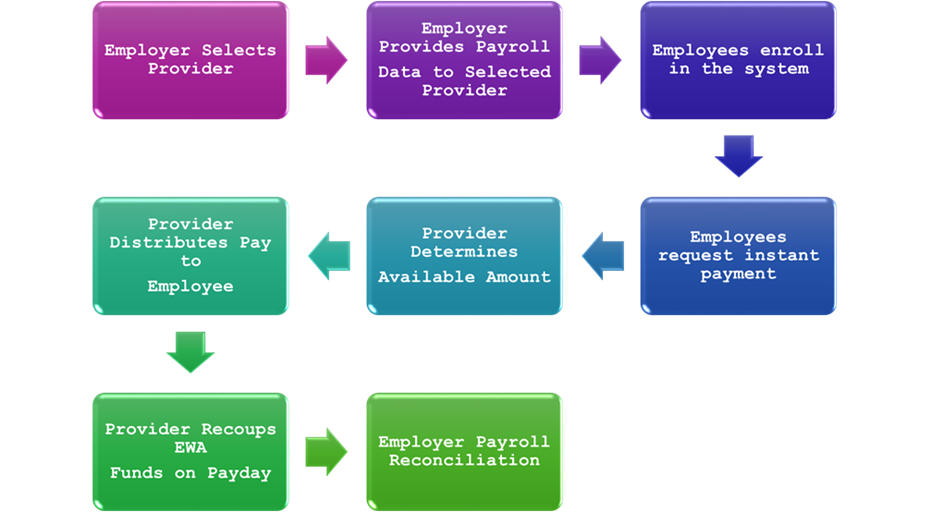

How Earned Wage Access Works

EWA programs are fairly straightforward. Here’s a general overview of how an on-demand payroll program typically works:

What are the Benefits of Earned Wage Access?

Access to earned wages offers numerous advantages to both firms and workers. Let’s examine some of the ways that each can anticipate receiving benefits.

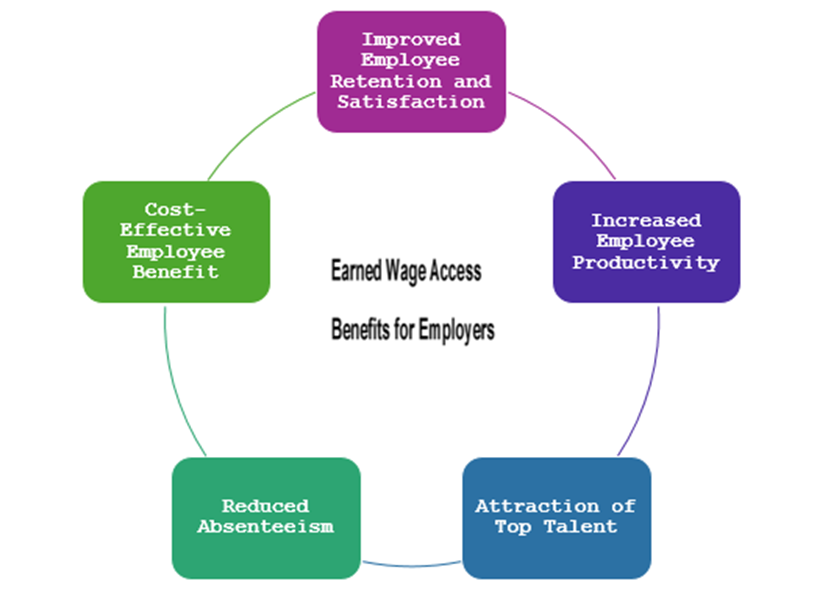

Earned Wage Access Benefits for Employers

Employers should acknowledge the advantages and take into account how earned income access will benefit their business as a whole, in addition to the demand of employees for it.

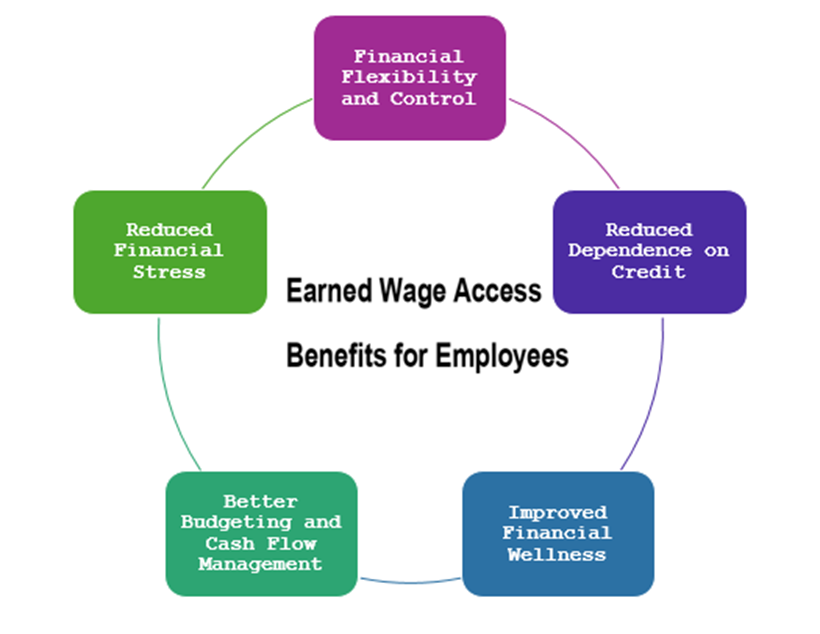

Earned Wage Access Benefits for Employees

One of the most frequent causes of employee turnover is financial stress. The 2022 PWC Employee Financial Wellness Survey found that employees who are under financial stress are twice as likely to hunt for a new position. Stress levels are higher among workers who are having financial difficulties, which can lower morale and reduce productivity.

Earned Wage Access Apps

Employees can track their wages, access their earned pay, save money, and enhance their financial well-being with the help of EWA apps. Earned wage access apps give workers a flexible and practical way to deal with cash flow issues by allowing them to access a portion of their earned wages before the regular payday. Apps that provide earned salary access are particularly helpful for employees who might have unforeseen obligations, like auto repairs or medical bills, and can’t wait for their normal paycheck to pay for them.

Earned Wage Access Laws in the United States

Access to earned wages has been more popular as a tool for employees’ financial well-being and as a recruiting and retention tool for employers.

- In the US, EWA was licensed as a separate financial product by Nevada and Missouri in 2023, and Wisconsin followed suit in 2024. Important disclosures are required by both licensing statutes to guarantee robust protections for all EWA users.

- In September 2023, EWA providers will need to comply with Connecticut’s small loan restrictions, according to guidelines released by the state.

- Governor Laura Kelly of Kansas signed House Bill 2560 into law in April 2024. Clear guidelines for approved EWA services are established by this new law.

- In May 2024, South Carolina Governor Henry McMaster signed Senate Bill 700 into law designating earned wage access as its financial product.

Popular earned-wage access companies

Payactiv, DailyPay and One@Work (formerly Even) are three popular earned wage access companies.

- On all workdays, employees can access up to 50% of their daily net profits with Payactiv. Employees can transfer funds instantly for free or for a cost of $1.99 or $2.99, depending on how the funds are received and whether direct deposit is set up. Normally, transfers take one to three business days.

- When you submit a request, DailyPay determines how much of your earnings can be deposited. For a charge of up to $3.99, users can receive their money immediately; for a fee of up to $1.99, they can do so the following business day.

- One@Work claims that users can receive money promptly for a charge and allows employees to access up to 50% of their wage. According to the corporation, transfers take one business day if users choose not to pay the cost.

References

Lux, M., & Chung, C. (2023). Earned Wage Access: An Innovation in Financial Inclusion?. M-RCBG Associate Working Paper Series.

Hawkins, J. (2021). Earned wage access and the end of payday lending. BUL Rev., 101, 705.

Alcazar, J., & Bradford, T. (2020). In the Nick of Time: The Rise of Earned Wage Access. Federal Reserve Bank of Kansas City Payments System Research Briefing, September, 23.

Dennis, M. (2023). Earned Wage Access: A Review of Current Research and Implications for Employee Financial Wellness. Available at SSRN 4551247.

MPhil, PhD Microbiology

Follow me ⬇️

Post Comment